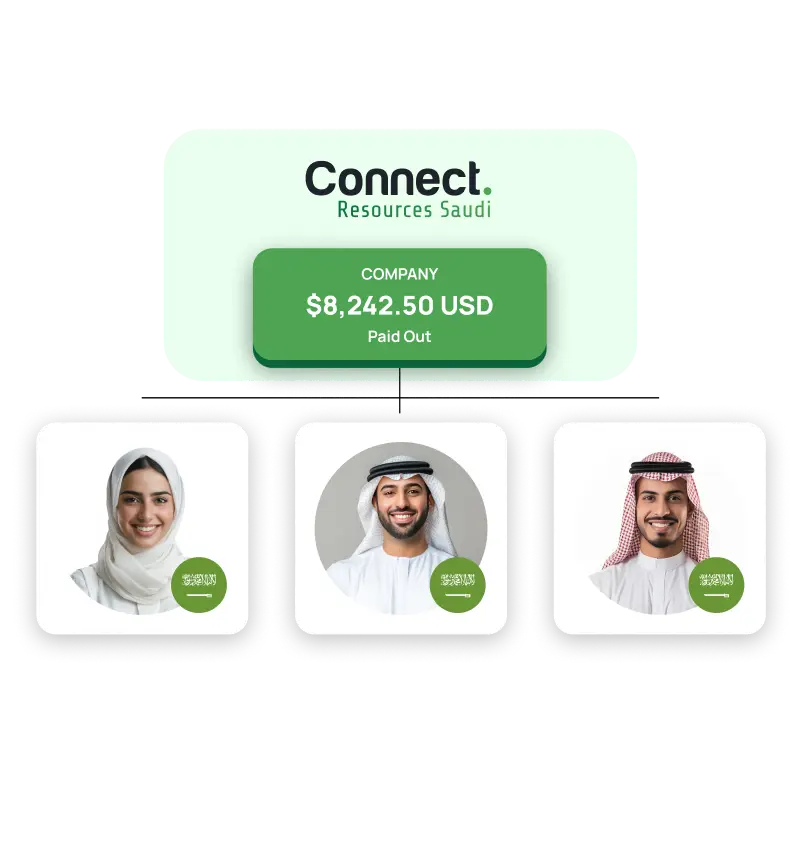

Leading Provider of Payroll Services in Saudi Arabia

Saudi Arabia’s dynamic market needs precise, compliant payroll solutions. Whether you’re a local or global business, our expertise, advanced technology, and commitment to excellence empower your payroll operations in KSA.

About Payroll Outsourcing in Saudi Arabia

Payroll outsourcing in Saudi Arabia entrusts your payroll to experts—ensuring compliance with labor laws, GOSI contributions, and WPS requirements. It covers salary disbursement and payroll management for both local and expatriate employees.

Outsourcing provides accurate, efficient, and secure solutions tailored to Saudi regulations. It gives you access to advanced payroll systems, minimizes non-compliance risks, and removes the burden of in-house payroll management.

10,000 Payrolls Flawlessly Handled Every Year.

78% of companies face payroll errors yearly; 25% lose efficiency due to outdated systems. At Connect Resources, we revolutionize payroll management in Saudi Arabia—reducing errors by 95% and ensuring 100% compliance with labor laws. Our in-country expertise covers local tax laws, GOSI contributions, WPS compliance, and employee compensation, including pensions, healthcare, and leave benefits. By outsourcing your payroll to us, you ensure accurate, timely, and compliant payments while cutting costs by up to 40%.

Discover accurate, efficient, and compliant payroll services in Saudi Arabia.

Accurate and timely salary processing boosts morale and trust.

Benefits of Our Payroll Service

Our cutting-edge payroll software and a team of experts guarantee the best results.

Save Time, Reduce Risks

Free up your HR team by outsourcing payroll. Ensure compliance with Saudi labor laws, GOSI, and WPS, avoiding penalties and legal risks.

Financial Savings

Eliminate the need for in-house systems and staff while accessing state-of-the-art payroll technology. Save money and improve operational efficiency.

Enhanced Employee Satisfaction

Timely and error-free salary disbursements build employee confidence and satisfaction. This not only creates a positive work environment but also promotes loyalty within your team.

Why Choose Us?

At Connect Resources, we manage over 10,000 payrolls annually with 100% accuracy and zero errors. From salary disbursement and GOSI contributions to WPS compliance and expatriate payroll management, our services ensure flawless processing aligned with Saudi labor laws. With advanced payroll systems, secure data management, and a dedicated team of experts, we simplify payroll complexities—keeping your business compliant and efficient.

FAQs

1. What does Payroll Outsourcing in Saudi Arabia (KSA) involve?

Payroll Outsourcing in KSA involves contracting with a third-party provider to manage employee salaries, benefits, and administrative tasks. It is a growing practice for businesses to manage payroll, compliance, and administration by hiring third-party experts. Specifically, this includes compliance with local regulations like the Wage Protection System (WPS) and GOSI.

2. What are the key advantages of outsourcing payroll services in Saudi Arabia?

Outsourcing payroll services provides several primary advantages for businesses:

- Strategic Focus: It allows employers to concentrate on their core business.

- Resource Allocation: It frees up business owners, HR, or accounting personnel to work on strategic tasks.

- Cost Savings: Companies can save costs by avoiding the need to use in-house resources to comply with complex payroll requirements.

- Error Avoidance: It helps avoid mistakes and tax compliance penalties.

- Efficiency: It provides ease of ongoing administration through changes in personnel or compensation structure.

3. How do Payroll Assistance Services in Saudi Arabia work?

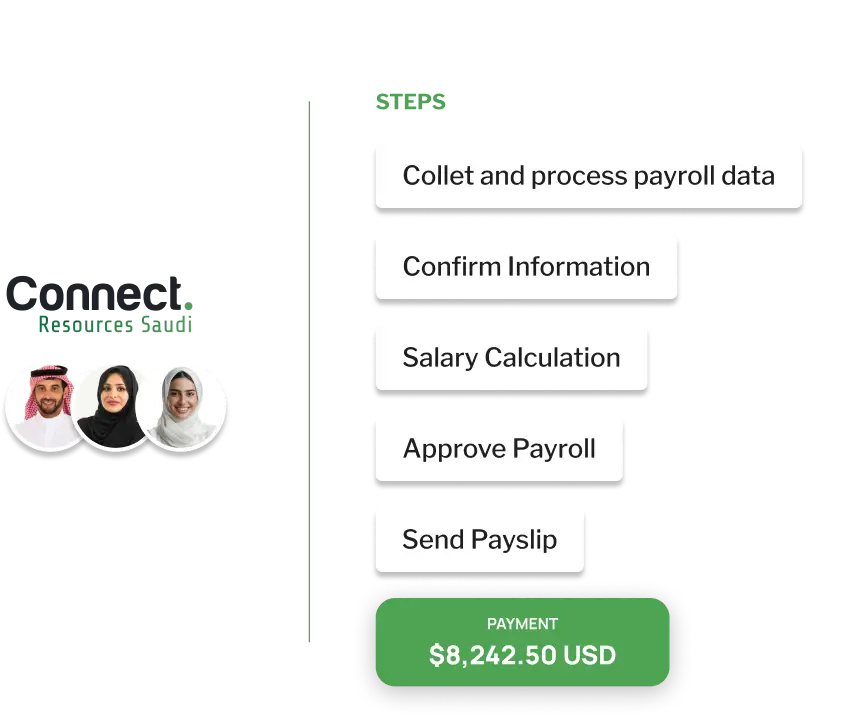

Payroll outsourcing in KSA generally includes all activities related to payroll processing and other related functions. Payroll processing includes several activities such as:

- Maintaining employee records.

- Calculating employee salary and wages.

- Computing and adding bonuses.

- Distributing payroll.

- Generating payroll-related reports.

- Complying with the taxation laws of the government.

4. What is required to administer compliant and accurate payroll in Saudi Arabia?

Administrating timely, accurate, and compliant Payroll in Saudi Arabia requires a deep understanding of local tax, reporting, employment, and compensation requirements. Our local experts provide up-to-date guidance on the specific tax legislation, compensation requirements, and benefits expectations. This includes handling:

- Corporate, income, and regional taxes.

- Social taxes, including pensions, healthcare, and unemployment.

- Compensation for holidays, vacation, and various types of leave.

- Other withholdings and employer contributions.

5. What administration options does Connect Resources offer for payroll?

Connect Resources offers two main solutions for administering payroll:

- EOR (Employer of Record): An Employer of Record solution that allows you to employ and pay international workers even if you do not have a local entity.

- Global Pay: A local payroll service KSA solution for your operations in a specific country where you already have an entity.

Grab a tea and let experts guide you through our payroll service!

=Hi

=Hi